Our priorities

Being a reference as a sustainable energy supplier that feeds people's lives - our corporate Purpose - determines our strategy inspired by sustainable development, with a business model that integrates the social and environmental dimension into the company's core business.

Group Stakeholders and Dialogue on Sustainability

For decades, Saras has held a dense participatory dialogue, often informal and sometimes structured with interviews and questionnaires, with stakeholders connected or shared with those of the company (the so-called "Stakeholders"), to identify the priority issues on which to act and strengthen collaboration with the territory of reference.

Among its stakeholders, the Group has identified some internal categories (employees of various levels, middle managers, executives, and top management) and others external (suppliers of goods and services, local communities, media, schools and universities, trade unions, bodies, institutions and representatives of the international financial community).

This broad representation guarantees a plurality of visions, which are essential to establish in an impartial manner the issues that are “material” for the Group.

Issue and impact definition

In continuity with what was already done last year, the impact analysis for the 2023 financial year covered the entire value chain in which the Saras Group operates, i.e. the hydrocarbons (oil and gas) industry as identified in the specific Standard "GRI 11: Oil and Gas 2021".

For the sake of completeness, it should be noted that last year the seven distinct phases of the hydrocarbon industry's value chain were identified, as schematically represented in the figure. These phases have all been taken into account, although the Saras Group is active only in a subset of these phases and, more precisely, in the refining, processing and storage of petroleum products.

To identify and analyse the main topics related to the environment, social responsibility and governance (ESG) from the perspective of the impacts generated by the company and its value chain, Saras had taken into account various sources (internal and external to the company), and carried out assessments that were then validated by the company's top management between December 2022 and January 2023.

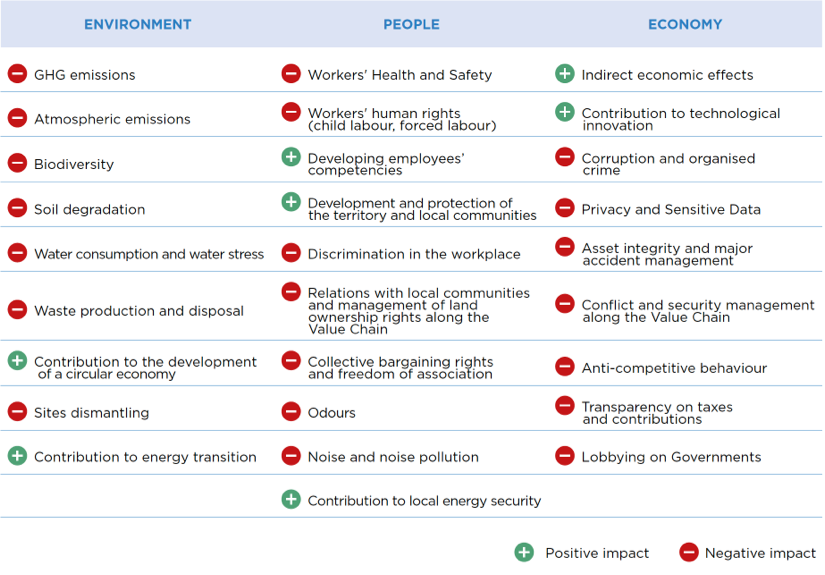

In addition to the above-mentioned "GRI 11" Sector Standards, the main national and international legislation in force (e.g. European Green New Deal, Legislative Decree 254/2016), the issues addressed by international sustainability reporting and rating agencies (S&P Global, MSCI, Moody's V.E., CDP, etc.), Benchmarking studies with Italian and foreign comparable companies (ENI, API Group, Neste Oil, Shell, BP, Equinor, etc.), the recognition of articles referring to the Saras Group and published by the Media (Ansa, Unione Sarda, Nuova Sardegna, etc.), the strategic orientation and internal documentation of the company (Sustainability Policy, Code of Ethics, Financial Statements, EMAS Declaration, AIA, etc.), as well as the indications of internal and external experts. A preliminary list of current and potential impacts was thus defined, divided into three categories: Environment, People, Economy (as shown in the graphic).

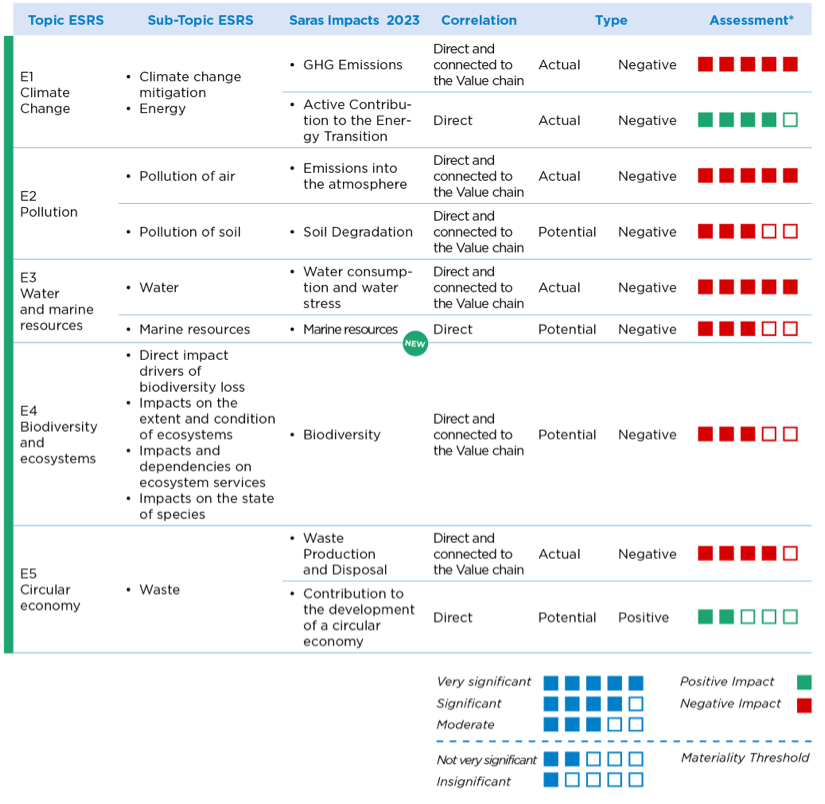

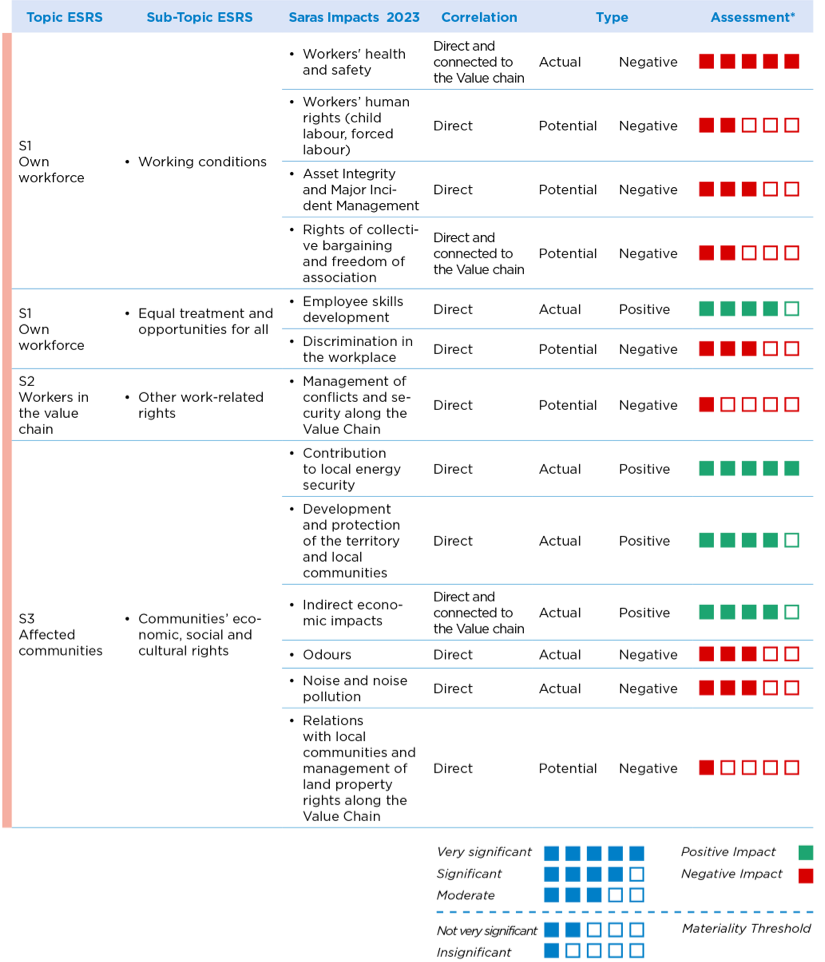

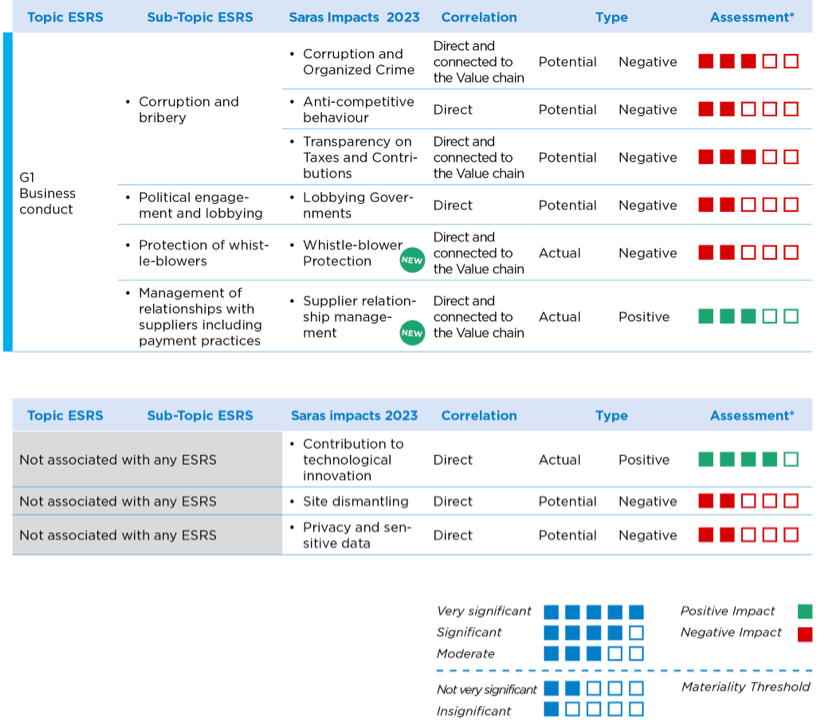

Specifically, we proceeded with the correlation between each impact that emerged from the 2022 relevance analysis and the themes and sub-themes of the ESRS. Furthermore, for sub-themes that did not have any associated impact, benchmark analyses were carried out to understand the consideration of the same by the main companies comparable to Saras.

This year, however, compared to the analysis conducted the previous year, a new element has been introduced deriving from the consideration of some additional sustainability aspects defined in the new European Sustainability Reporting Standards (ESRS). In particular, all the topics and their sub-topics and sub-sub-topics listed in the ESRS 1 standard were examined with the aim of assessing any aspects that may not have been intercepted with the analyses previously illustrated.

Environment

People

Economy

Materiality Analysis

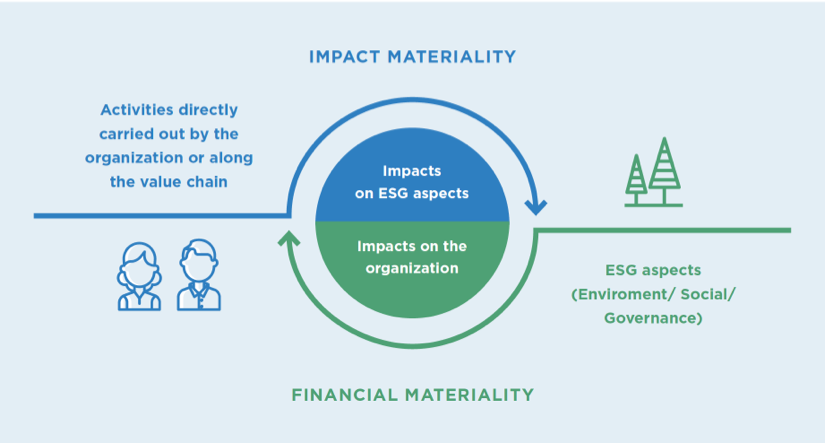

Until the Sustainability Report of 2022, Saras' analysis focused exclusively on defining material topics as stipulated in the reporting standards "GRI 3: Material Topics 2021". Specifically, material topics were considered those associated with real and/or potential significant impacts that the organization generates on the economy, the environment, people, including impacts on human rights (directly and/or indirectly, i.e., through its own operations or through activities along the upstream and downstream value chain). This methodology is commonly referred to as "impact materiality".

Starting from the present Sustainability Report of 2023, Saras voluntarily extended the materiality analysis to a second dimension, the financial dimension, in order to anticipate the reporting obligations that will be introduced by the new Corporate Sustainability Reporting Directive (CSRD) starting from documents referring to the 2024 financial year (thus prepared at the beginning of 2025).

In particular, risks and opportunities that may influence Saras from a financial perspective were also identified, affecting business development, economic results, financial position, cash flows, and access to and/or cost of short, medium, or longterm financing. This second dimension of analysis is called "financial materiality".

This new analysis based on two dimensions – namely the relevance of impacts and financial relevance – is termed "dual materiality analysis" and entails that ESG issues are considered material when they are material for both or even just one of the two dimensions.